Toronto, January 27, 2025 – CatIQ, the independent Toronto-based organization providing industry-wide catastrophe insurance data and subsidiary of PERILS, has today disclosed its fourth industry loss estimate for the wildfire complex that affected Jasper, Alta, between July 22 and August 17, 2024.

The fourth estimate, which provides a snapshot of the insurance market six months post-event, is CAD 1.23 billion. This compares to the third loss estimate of CAD 1.05 billion, issued 90 days following the event. The loss number covers property (both commercial and residential) and vehicle (motor) claims, with commercial changes leading to the increase between estimates.

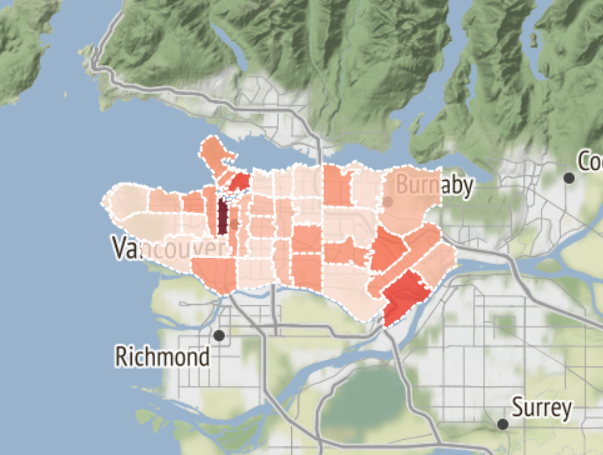

The updated loss report provides a detailed breakdown of property and motor losses by FSA (high-resolution CRESTA Zones). Also available via the CatIQ subscriber platform are detailed meteorological information including fire perimeter updates, evacuation dates, damage reports, news items, and images of damage caused by the event.

In line with the reporting schedule, a fifth update of the market loss from the Jasper wildfire will be made available on July 22, 2025, twelve months after the event start date.

On July 22, 2024, Parks Canada announced they were responding to multiple new fire starts in Jasper National Park. Two fires, burning south and northeast of the Jasper townsite, were of particular concern given their proximity to the community and the very dry, windy conditions, prompting officials to issue evacuation orders for all of Jasper. Driven by strong southerly winds, the South Fire reached the Jasper townsite by the evening of July 24 and damaged or destroyed 358 of the town’s 1,113 structures.

Canada has recorded at least one fire-related catastrophe each year since 2021, with recent events including the 2023 fires in Kelowna, British Columbia, and near Halifax, Nova Scotia. While these fires affected larger population centres than the Jasper fire, the property damage at the Jasper townsite was much more extensive. Notably, commercial line losses make up more than half of the incurred losses in Jasper.

Laura Twidle, President and CEO of CatIQ, commented, “The Jasper wildfire is the second costliest wildfire on record for Canada, behind the 2016 Fort McMurray wildfire which, at the time, generated insured losses of CAD 3.64 billion and 33,000 personal property claims. Though the Jasper event resulted in only about 1,700 personal property claims, the sums are much larger – on average more than four times the amount of the claims from Fort McMurray. This underscores the reality that a fire does not need a massive footprint to cause significant losses.”

Twidle continued, “The wildfire caused significant damage to the Jasper townsite and the surrounding area, forcing thousands of people from their homes for nearly a month, with many properties destroyed. The Jasper wildfire has had a devastating impact on the communities affected and through the data CatIQ and PERILS provide to insurers and other stakeholders our goal is to help mitigate similar losses in the future.”

About CatIQ and PERILS

Toronto-based Catastrophe Indices and Quantification Inc. (CatIQ), a subsidiary of Zurich-based PERILS AG, is Canada’s loss and exposure indices provider, delivering detailed analytical and meteorological information on Canadian natural and human-made catastrophes. Through its online subscription-based platform, CatIQ caters to the needs of the insurance / reinsurance / ILS industries, public sector, and other stakeholders, with comprehensive insured loss and exposure indices and related information. PERILS is an independent Zurich-based organisation providing industry-wide natural catastrophe exposure and event loss data. The PERILS Industry Exposure & Loss Database is available to all interested parties via annual subscription. The use of CatIQ and PERILS exposure and loss data other than in conjunction with a valid License and according to its terms, by a Licensee or an Authorized User as defined in the License, is illegal and expressly forbidden.

More information can be found on www.catiq.com or www.perils.org

PR Contact

Nigel Allen, +44 7988 478824, nigel.allen@perils.org