Products

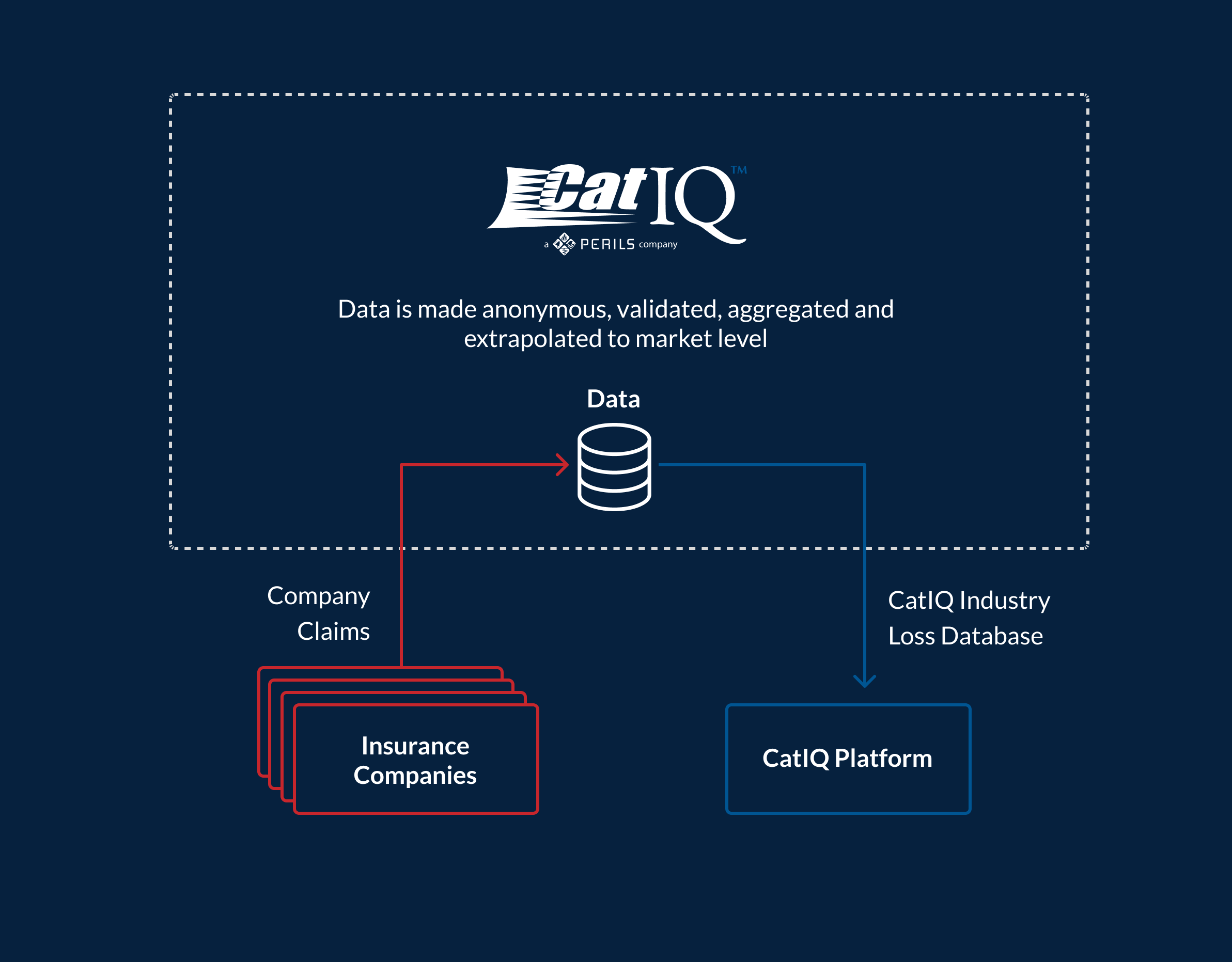

Through a state-of-the-art platform, CatIQ delivers analytical and meteorological information on Canadian natural and human-made catastrophes.

The CatIQ Platform is comprised of three main parts: Catastrophe Loss Database, Industry Exposure Database, Catastrophe forecasting.

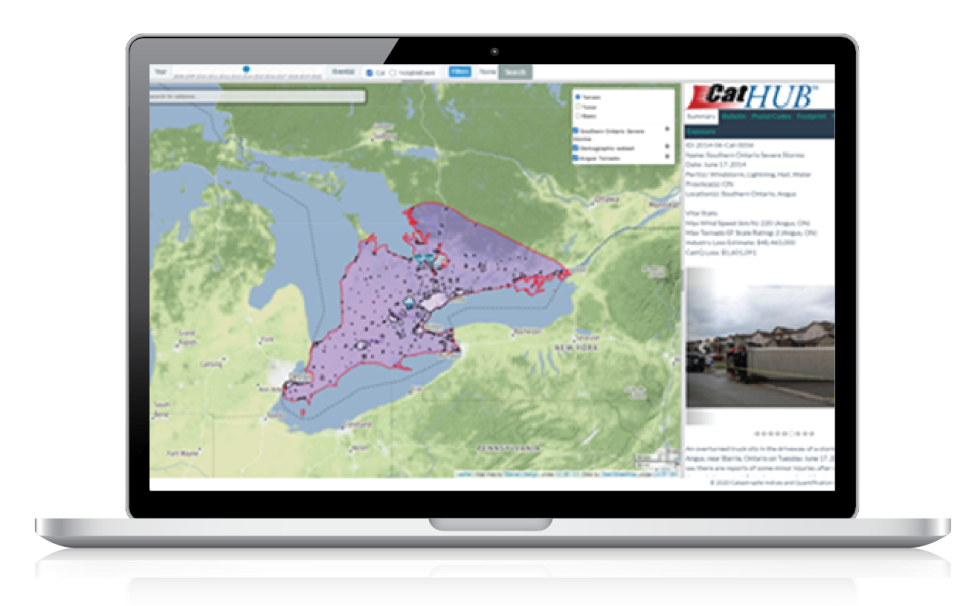

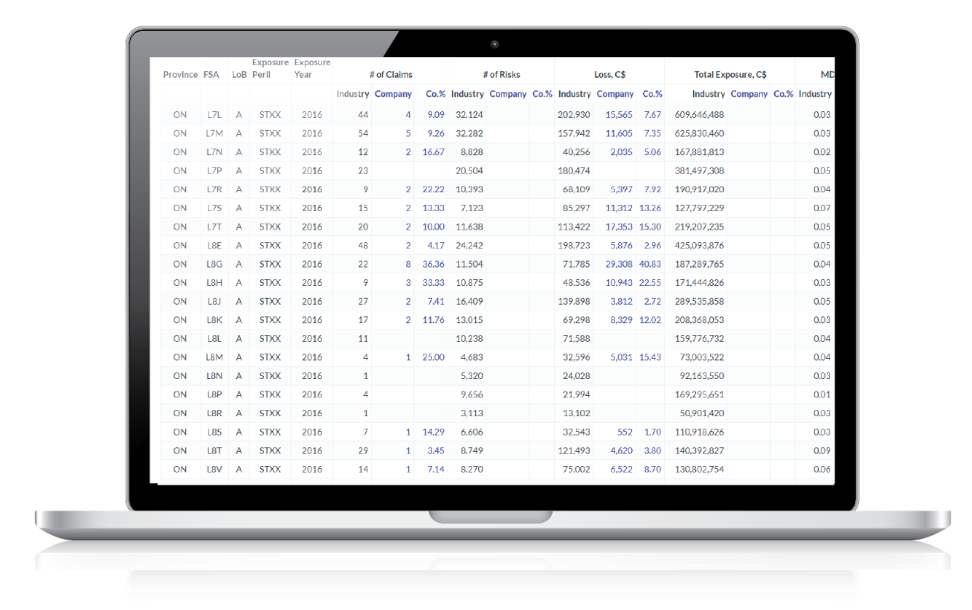

Catastrophe Loss Database

CatIQ’s loss data is displayed alongside the Canadian catastrophe database. This database contains loss information collected directly from insurers, along with meteorological and damage details, for all catastrophes in Canada since 2008. Specific loss data is produced for CATs by province and by line of business. A CAT is as an event that results in more than C$30M of insured loss for the industry.

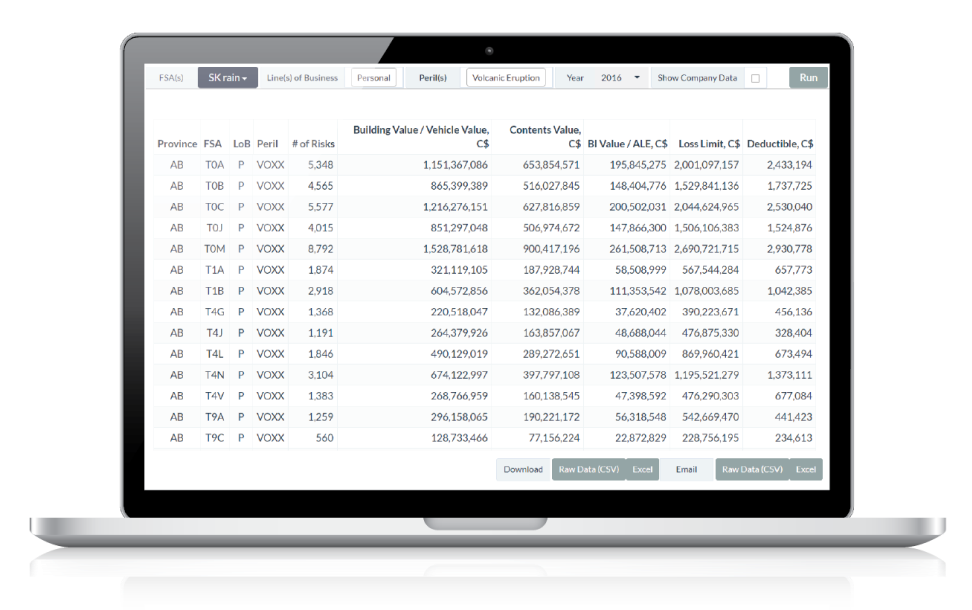

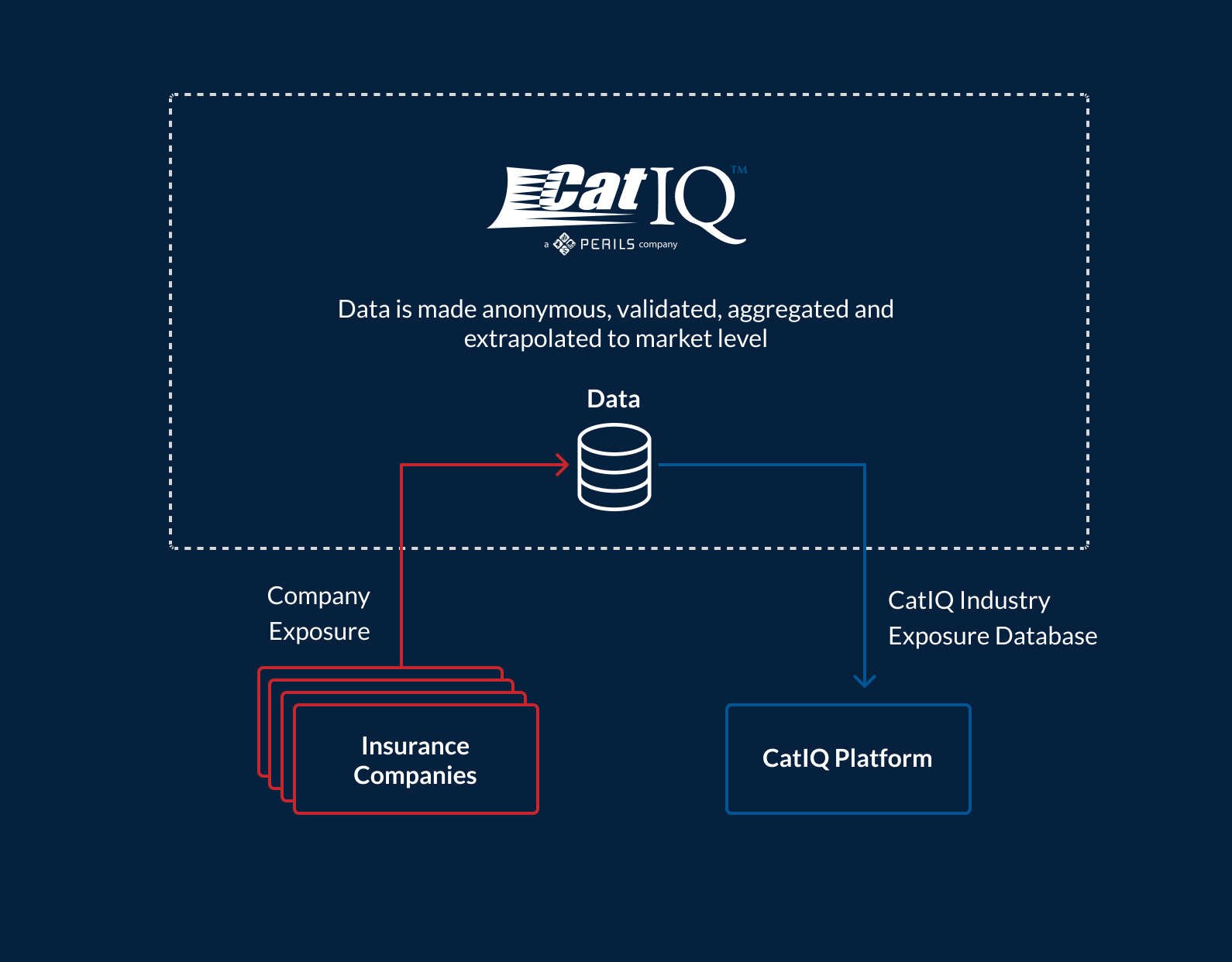

Industry Exposure Database

CatIQ’s Industry Exposure Database (IED) includes annually updated total sums insured information. The IED follows PERILS AG’s globally recognized methodology and uses a ground-up approach by collecting information directly from insurers to produce industry exposures for all of Canada.

Catastrophe Forecasting

CatIQ subscribers receive alerts of potential property damage events, giving stakeholders critical information on the expected location and magnitude of an event, up to three days in advance.

Industry Loss Index Service

CatIQ is designed to be used as an industry loss index, trigger, and independent CAT designator for Cat Bonds, ILS, ILW and other instruments.